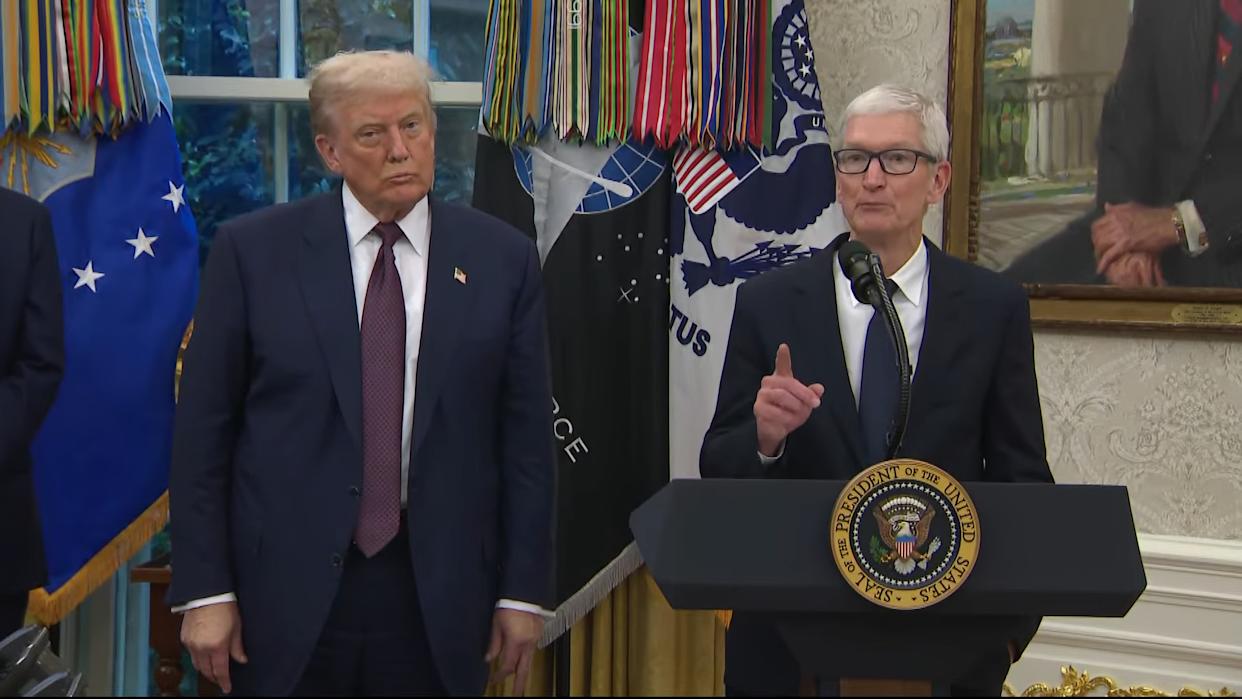

Apple has announced it will invest an additional $100 billion in the United States, raising its total planned investment to $600 billion over four years. The expansion follows President Trump’s decision to impose a 100 percent tariff on chip imports, with exemptions for companies manufacturing domestically. A White House spokesperson noted the move aligns with efforts to reshore critical component production for economic and national security purposes.

The additional funds will deepen Apple’s investments in American component manufacturers, including Corning and Amkor. Corning produces the glass used in iPhones and Apple Watches, while Amkor operates advanced chip packaging and testing facilities in Arizona. Apple describes these initiatives as steps toward establishing a domestic end-to-end silicon supply chain.

Apple also plans to collaborate with Samsung to produce advanced chip technology, including image sensors for iPhone cameras, to be manufactured in Texas. Additional US expansions will involve Texas Instruments, Broadcom, and GlobalFoundries. These steps are partly intended to mitigate potential tariffs while maintaining control over the supply chain.

The company’s initial $500 billion investment plan was focused on building Apple Intelligence servers in the US and expanding research and development in AI, software, and silicon engineering. The newly announced funding extends these efforts and highlights Apple’s long-term strategy to strengthen domestic manufacturing.

Apple’s current approach mirrors past interactions with the Trump administration, such as the 2019 opening of a Mac Pro factory in Texas, which had been operational since 2013 but was publicized to satisfy political optics. Analysts note that Apple’s resources allow it to absorb or avoid tariffs, while also presenting its investments in a way that aligns with government expectations.