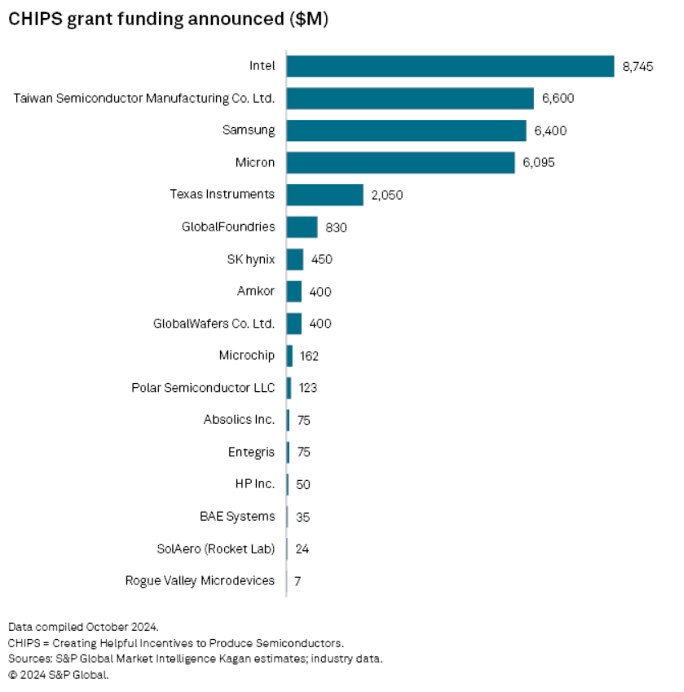

The Trump administration is redefining the parameters of the CHIPS and Science Act (CHIPS Act), particularly concerning equity stakes in companies receiving federal funding. While Intel has agreed to a 10% equity stake in exchange for $10.86 billion in grants, not all recipients are subject to similar terms.

Intel’s Equity Agreement

Intel’s arrangement marks a significant development in U.S. industrial policy. The company has agreed to convert nearly $9 billion in CHIPS Act grants into a 10% equity stake for the U.S. government. This move aligns with President Trump’s vision of creating a sovereign wealth fund and is seen as a model for future economic initiatives .

However, Intel has expressed concerns about potential risks associated with this agreement. In a securities filing, the company warned that the government’s stake could harm international sales, complicate future access to government grants, and lead other governments to reevaluate their financial support. Additionally, the equity arrangement may dilute existing shareholders and affect Intel’s ability to raise capital in the future .

Exemptions for Major Investors

In contrast, companies like Taiwan Semiconductor Manufacturing Company (TSMC) and Micron Technology are exempt from giving up equity. The administration has clarified that it will not seek equity stakes from these companies, as they are significantly increasing their U.S. investments. TSMC, for instance, has committed to a $100 billion investment in the U.S. over the next four years, including the construction of multiple fabrication plants and research centers .

Legal and Political Implications

The decision to take equity stakes in certain companies has sparked legal and political debates. Critics argue that such measures amount to overreach and excessive government intervention in the private sector. Moreover, companies are already required to share revenue with the U.S. government if profits rise above a certain amount, raising questions about the necessity of additional equity demands .

Strategic Shift Toward Critical Minerals

In a related development, the Trump administration is considering redirecting up to $2 billion from the CHIPS Act to support critical minerals projects in the U.S. This move aims to reduce dependence on foreign sources, particularly China, for essential materials like gallium and germanium, which are crucial for semiconductor manufacturing. The reallocation would focus on mining, processing, and recycling operations, with an emphasis on strengthening the domestic supply chain for these strategic resources .

Conclusion

The Trump administration’s approach to the CHIPS Act reflects a nuanced strategy that balances incentivizing domestic investment with ensuring taxpayer returns. While Intel’s agreement sets a precedent for equity stakes, exemptions for major investors like TSMC and Micron highlight the administration’s targeted approach. The potential redirection of funds to critical minerals underscores a broader vision of strengthening U.S. technological and economic security.